Custodial Account

Acorns Early Invest

Invest for the kids in your life now, because time goes fast.

Get started

Open an Acorns Early Invest account now to invest for the kids in your life

Sign up in minutes

Sign up in minutes

Just add a name, birthday, and SSN

Just add a name, birthday, and SSN

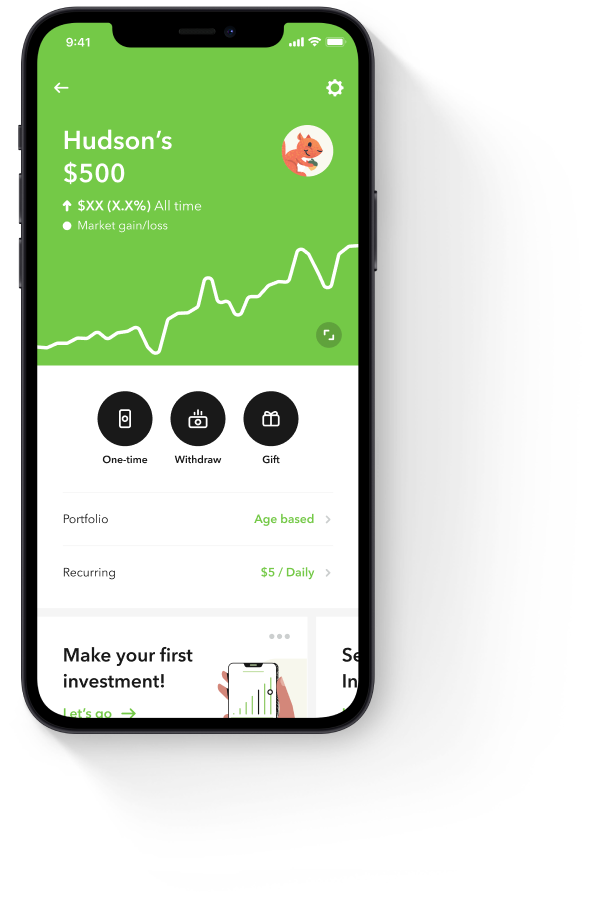

Simple, automatic recurring contributions

Simple, automatic recurring contributions

Use the funds in ways that directly benefit the child

Use the funds in ways that directly benefit the child

Easily transfer the funds over to an Acorns Invest account for the child when they are grown

Easily transfer the funds over to an Acorns Invest account for the child when they are grown

Potential tax advantages along the way

Potential tax advantages along the way

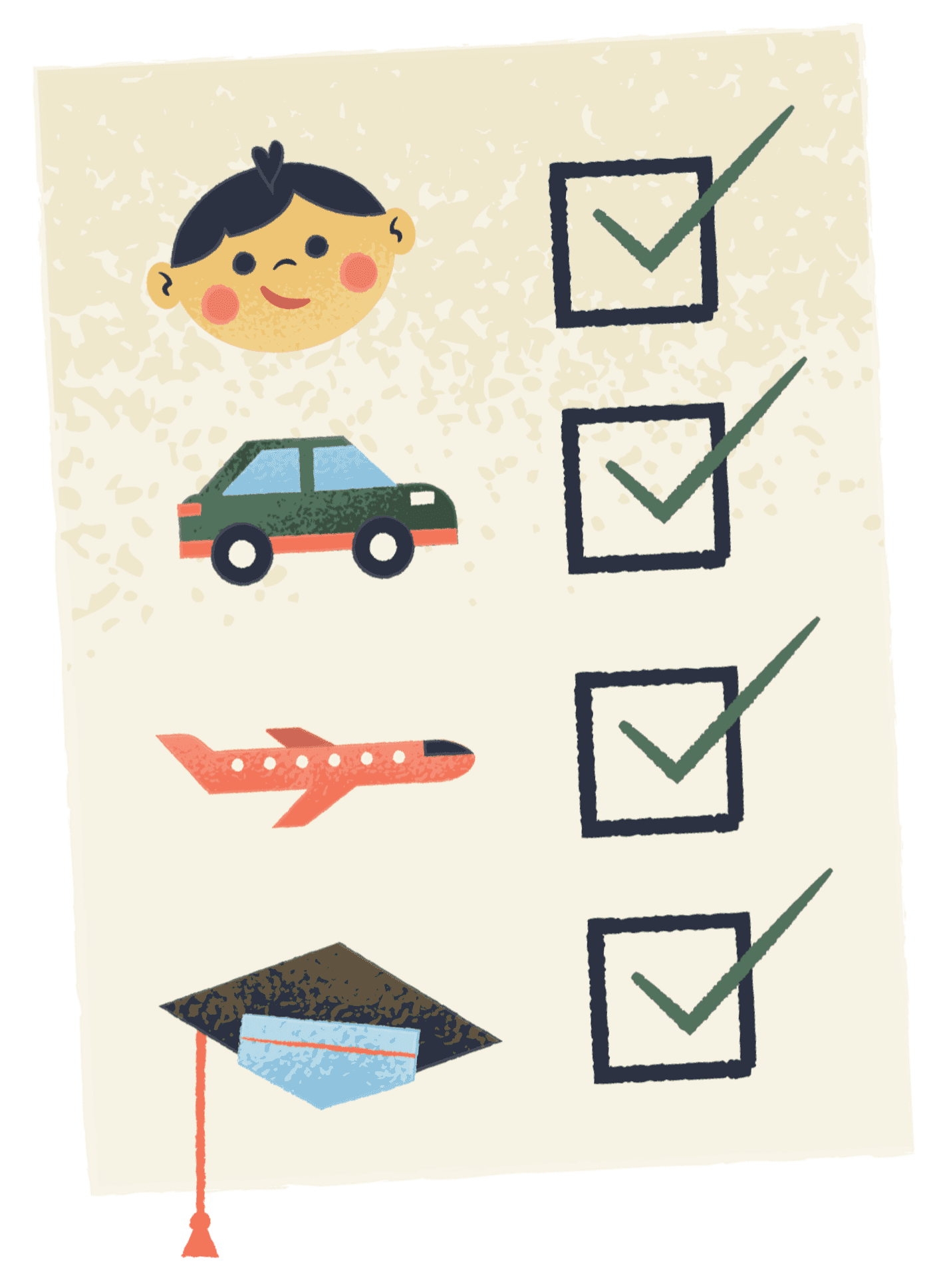

Invest a piece of every paycheck automatically

Invest a piece of every paycheck automatically

Pick how much to invest, starting at 1%, and change it any time

Pick how much to invest, starting at 1%, and change it any time

Allocate a percentage to your Invest, Later, and Early Invest accounts

Allocate a percentage to your Invest, Later, and Early Invest accounts

Frequently asked

How does Acorns Early Invest work?

Acorns Early Invest is our investment account for kids that can come with potential tax benefits. If you are in the Gold subscription, Acorns Early Invest is built into your subscription at no extra cost.

- Get started in minutes and add multiple kids at no extra cost.

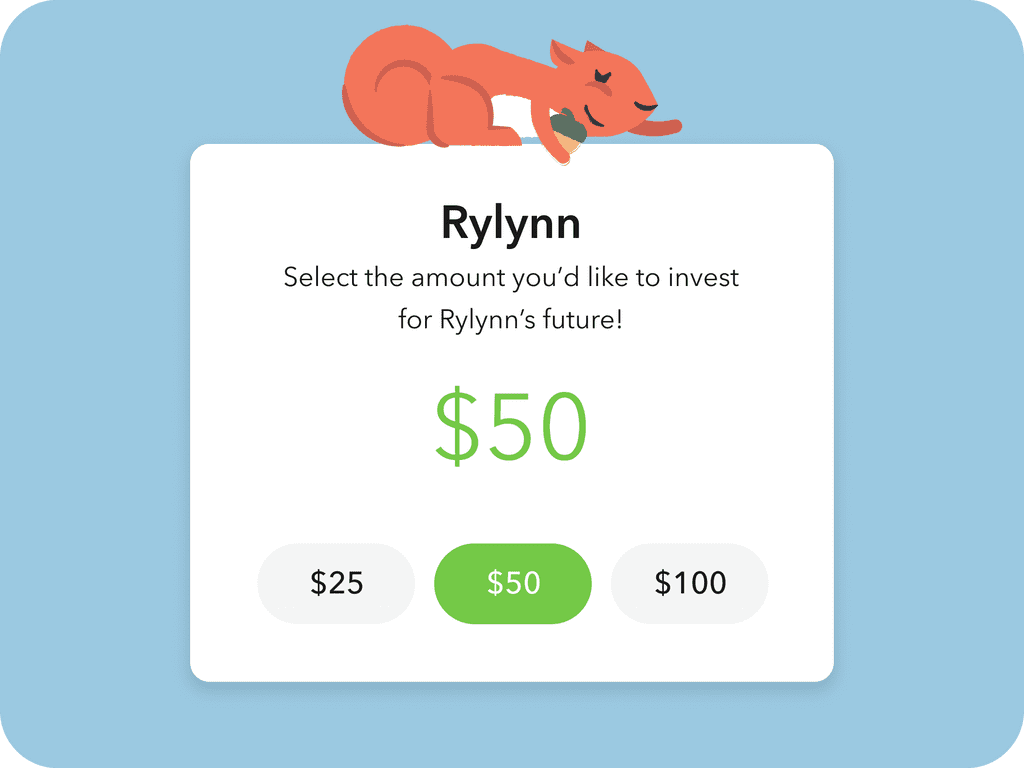

- Set up an easy Recurring Investment for the child you love.

- Get potential tax benefits while you invest.

- Acorns Early Invest is a UTMA/UGMA account, which stands for Uniform Transfer/Gift to Minors Account. This type of account is more flexible than a traditional college savings account and the funds can be used in other ways that directly benefit the child.

- Invite friends and family to invest for the child, too!

Don’t have kids? With Acorns Early Invest, you can start an account for any child in your life!

To explore Acorns Early Invest, tap “Invest” from your home screen or tap the Invest icon from your bottom navigation.

Then, tap “Early”.

Have the child’s birthday and social security number ready to get started. Social security numbers are required to open any investment account. We use data encryption and bank-level security to protect your personal information. Remember to talk to your tax advisor or visit IRS.gov for information on tax benefits that may apply to you.

Acorns Early Invest makes it easy to invest for the child or children you love, and instill smart money habits early in life.

What portfolio is selected for my Early Invest account?

All Early Invest customers are placed into our “Aggressive Portfolio”.

When can kids access money in their Early Invest accounts?

Children can access the funds in their Early Invest account when they reach the age of transfer. The specific age of transfer is determined by each state, and may be anywhere from 18 to 25. Acorns will contact you with guidance when the age of transfer is approaching.

Why should I invest in an Early Invest account instead of a 529?

Actually, you can invest in a 529 and an Acorns Early Invest account. You don’t have to choose. The primary difference between the two is that funds held in 529s are intended solely for qualified educational expenses.

Funds you invest in Early Invest can be used for expenses that directly benefit the child named on the account, so many people find them to be more flexible.

And, while both types of investment accounts come with potential tax benefits, they vary. Visit irs.gov to learn the latest.

What do I need to open an Early Invest account?

You can open an Acorns Early Invest account for any child under the age of 18, whether they’re your own child, a niece or nephew or even the child of a friend. All you need is the child’s full legal name, date of birth, and Social Security Number.