Banking for the growth-minded

No hidden fees - No hidden fees - No hidden fees - No hidden fees - No hidden fees - No hidden fees - No hidden fees -

Hidden fees.

Minimum balance fees.

Overdraft fees.

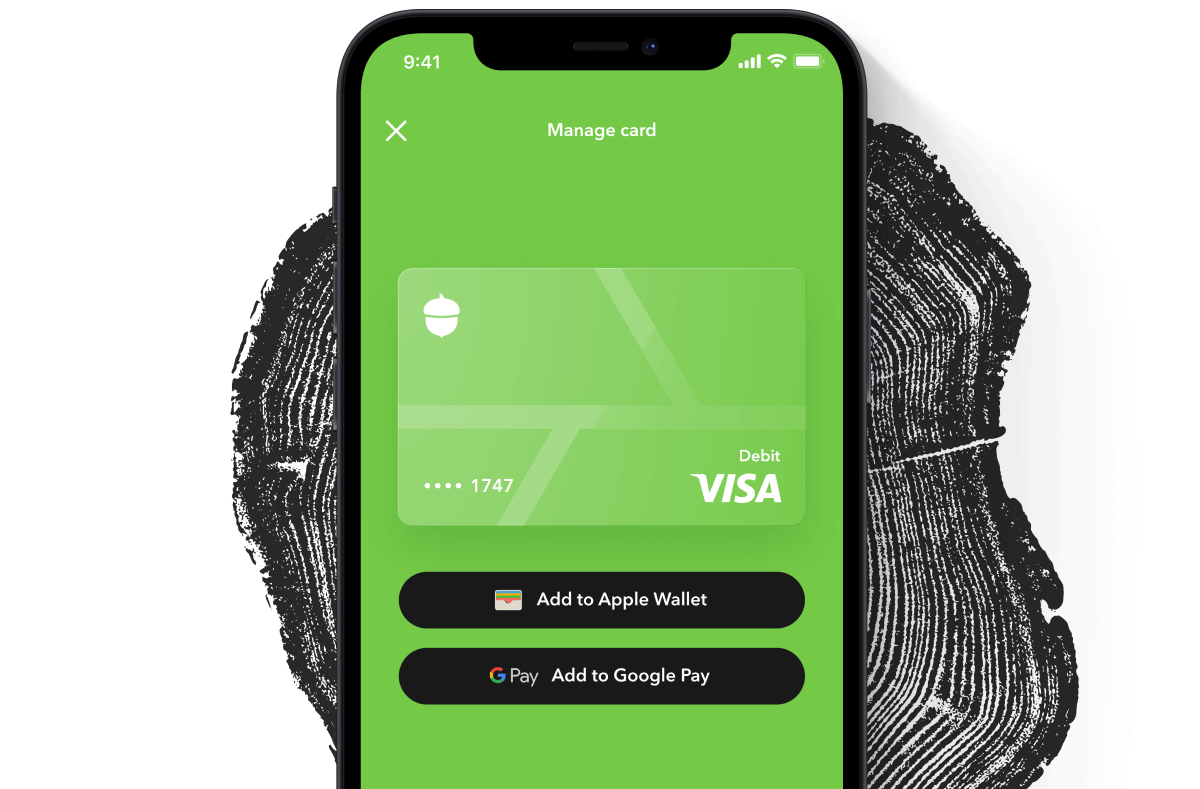

Hello metal.

Heavy metal core

Heavy metal core

Matte, Acorns-green finish with oak branch

Matte, Acorns-green finish with oak branch

Laser-engraved signature

Laser-engraved signature

FDIC-insured up to $250,000

FDIC-insured up to $250,000

Fraud protection

Fraud protection

256-bit data encryption

256-bit data encryption

Instant all-digital card lock

Instant all-digital card lock

Frequently asked

What is Acorns Checking?

Acorns Checking is our smart checking account that invests while you spend. Acorns Checking comes with your subscription, at no extra cost.

Why should you switch to Acorns Checking?

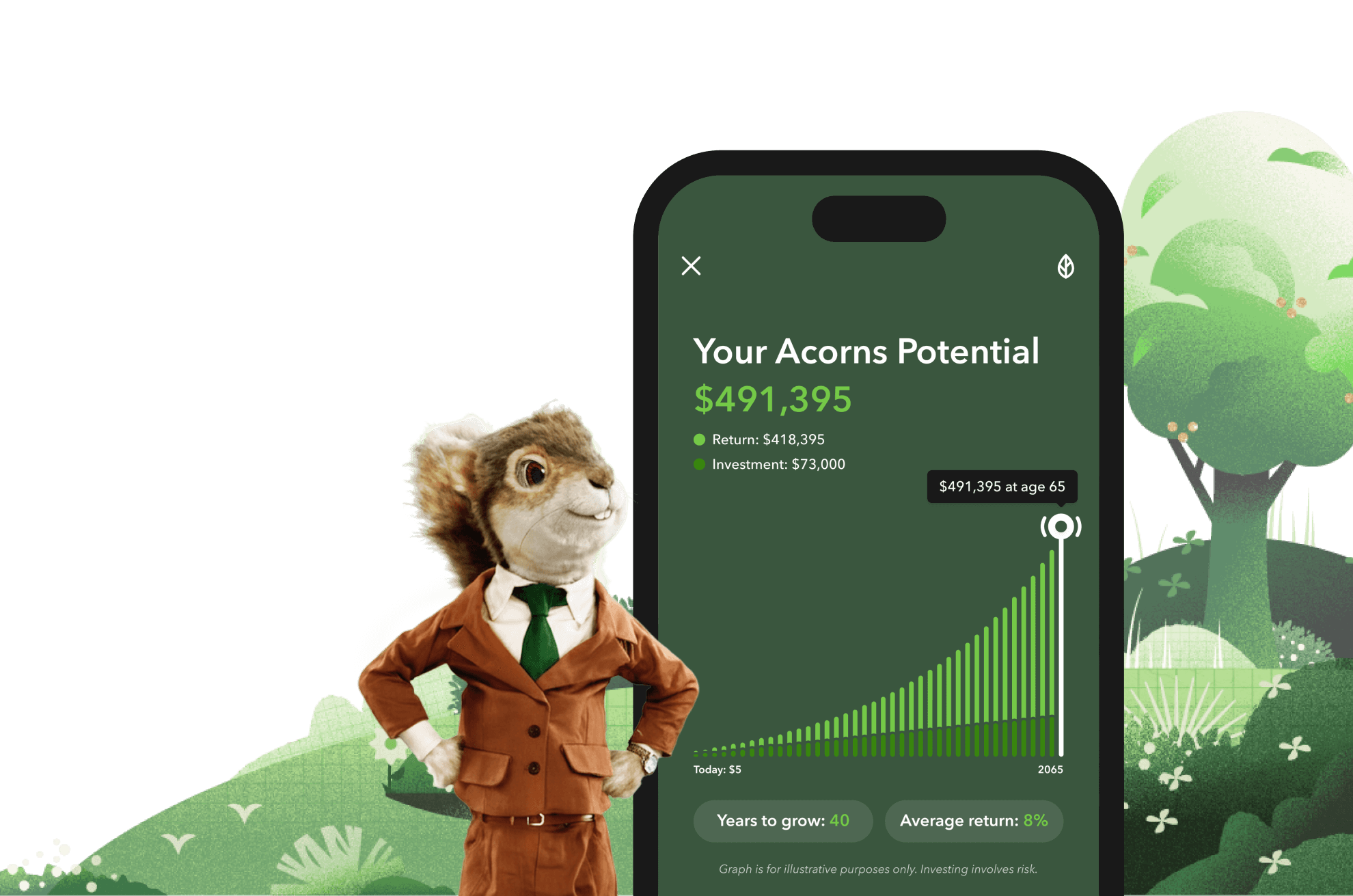

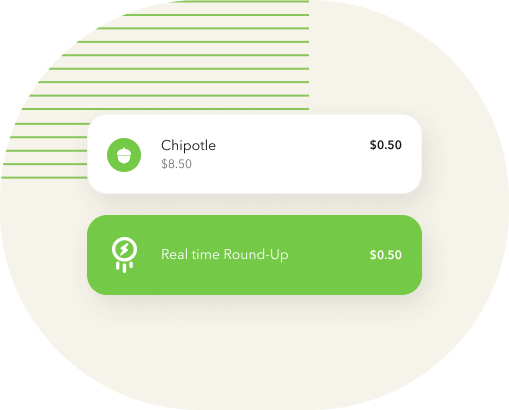

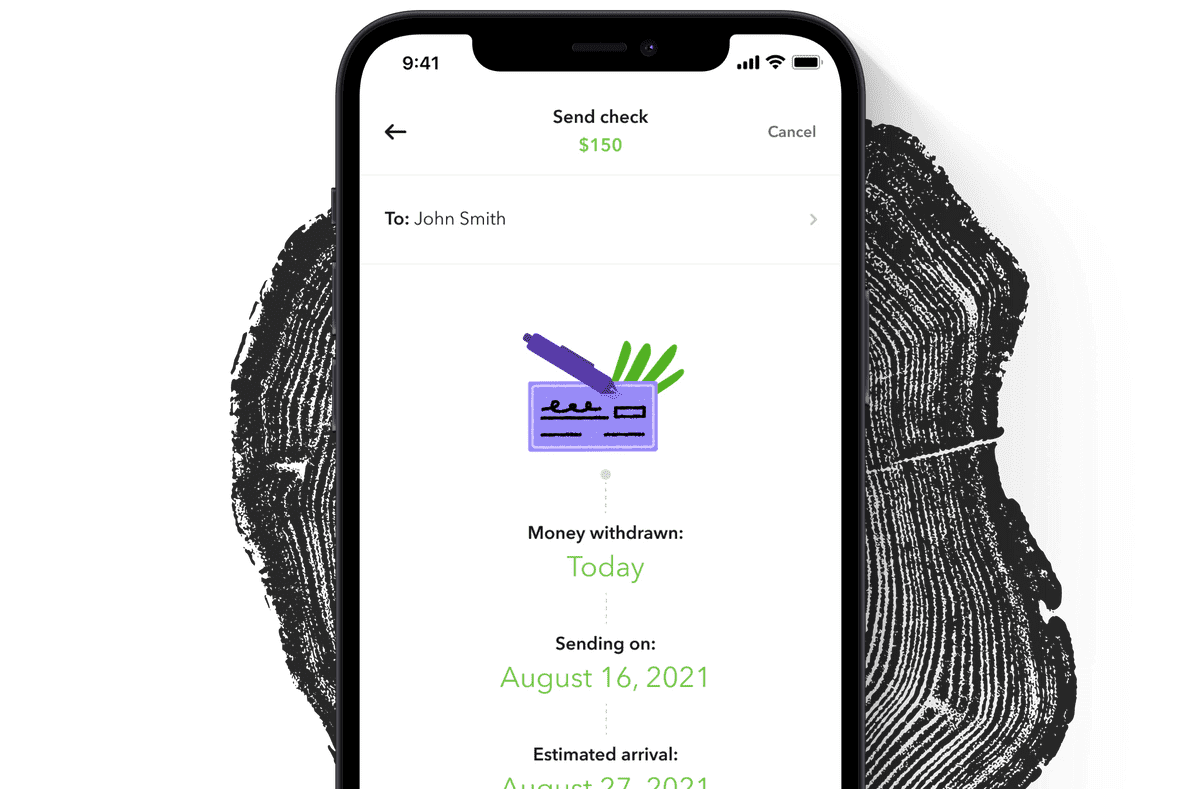

- Real-Time Round-Ups® investments allow you to invest spare change with every swipe, instead of waiting for it to add up to $5.

- Paycheck Split can automatically invest a piece of your paychecks as soon as you get them, into any of your investment accounts.

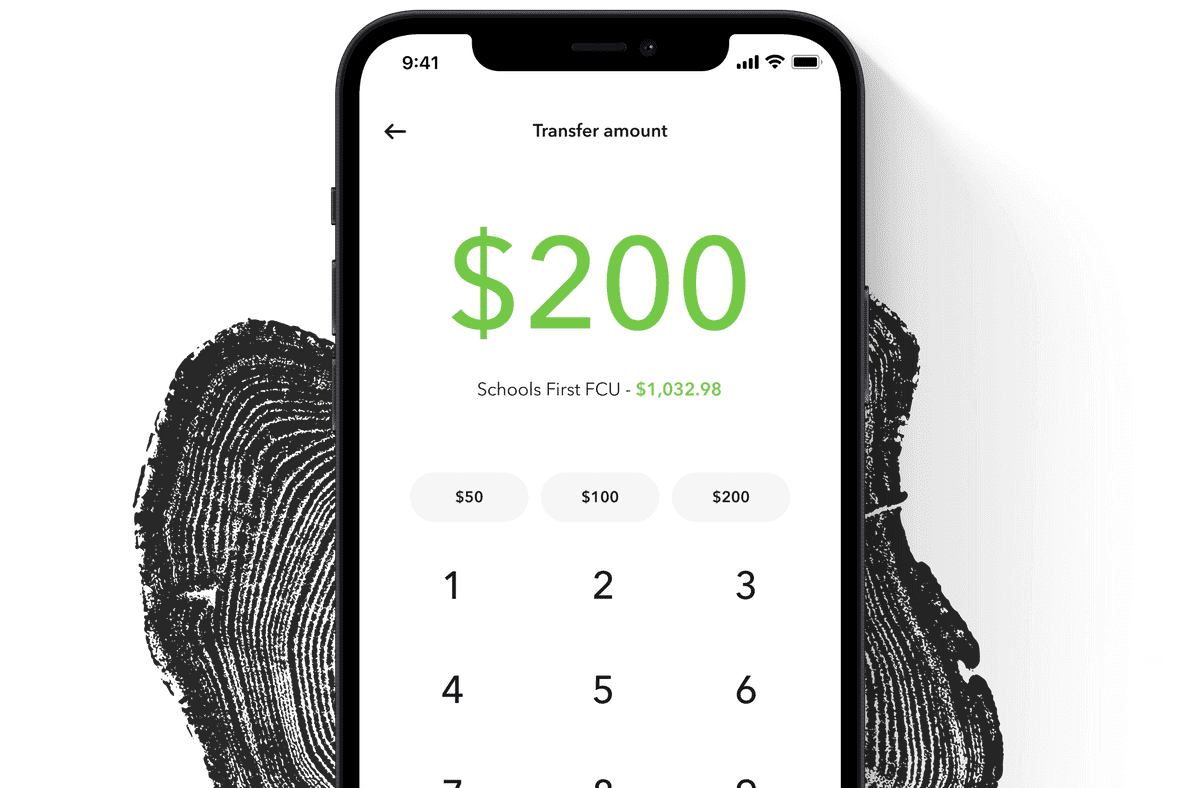

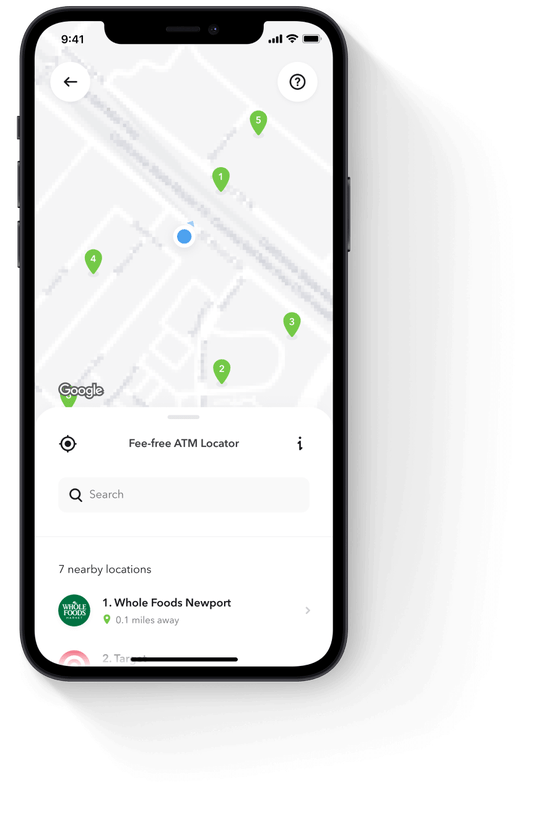

- 55,000+ fee-free ATMs, and no overdraft or low-balance fees.

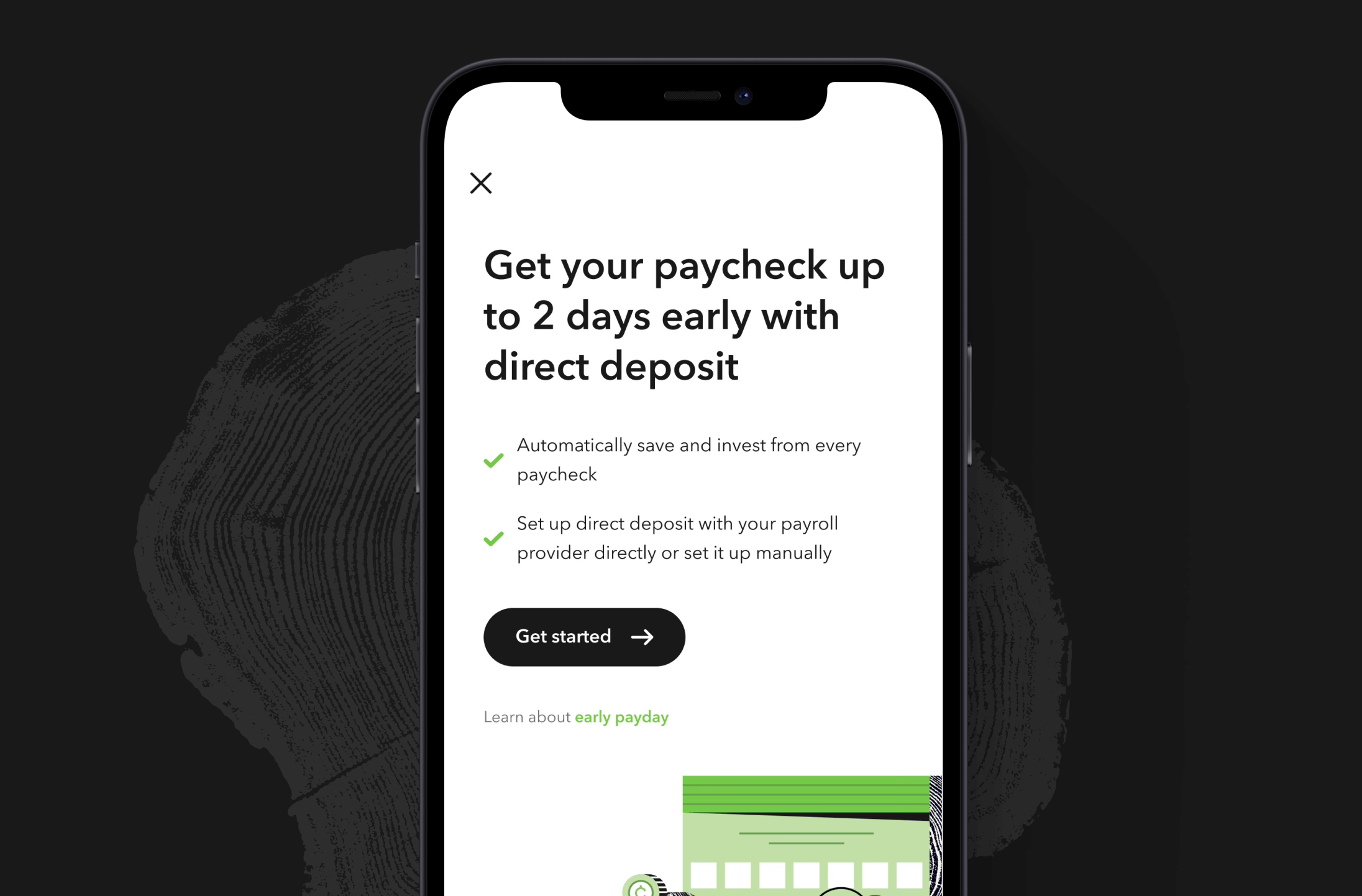

- Plus, you can get paid up to 2 days early if you use Acorns Checking Direct Deposit

Get your heavy-metal, Acorns Visa™ green debit card, and simplify your life with investment, retirement, and checking accounts all in one app.

To explore Acorns Checking, tap “Checking” from your home screen, or tap the Checking icon from your bottom navigation.

If you’re not an Acorns Checking Direct Deposit customer yet, be sure to set up Direct Deposit next so that you can access Paycheck Split, and invest a piece of every paycheck automatically.

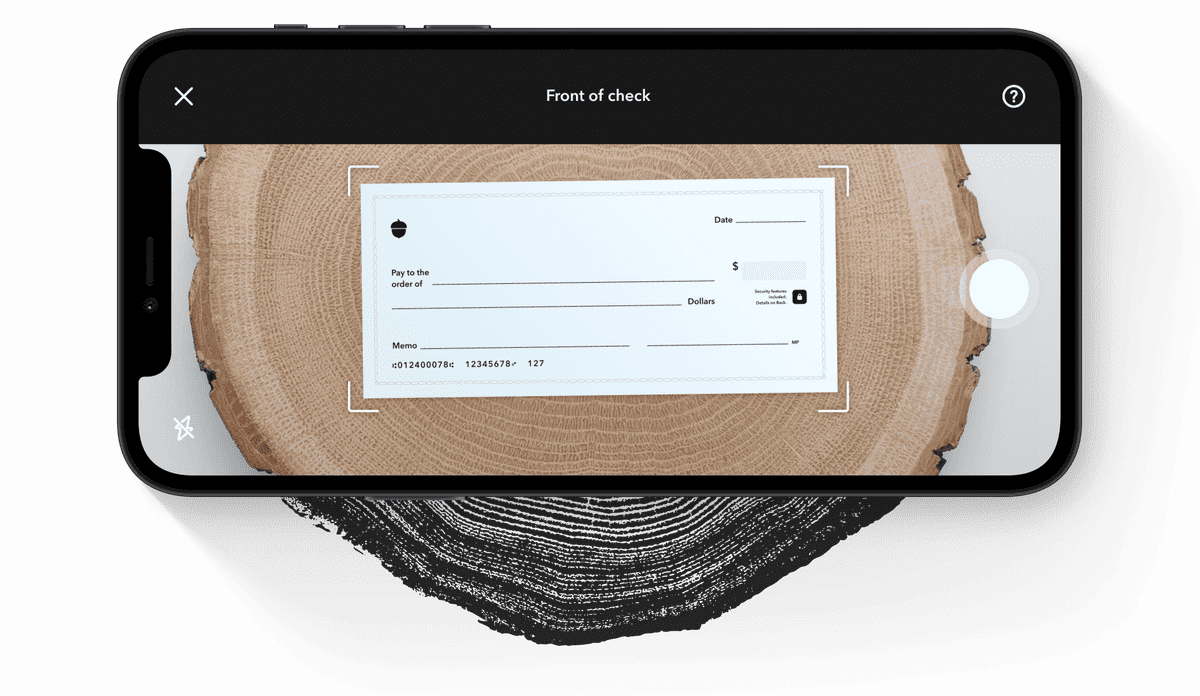

How do I set up Direct Deposit?

There are a couple of ways you can set up Direct Deposit into your Acorns Checking account. The easiest option is to set it up right from your Checking account settings by connecting directly to your employer or payroll provider. We also give you the option to download a pre-filled PDF Direct Deposit enrollment form that you can provide to your employer.

Do I have to maintain a minimum account balance?

There is no minimum amount required to open an Acorns Checking account.

Are there fees for banking with Acorns?

Acorns Checking is included in all Acorns subscriptions, which features a host of products and tools. Acorns does not charge overdraft fees or minimum balance fees, and your Acorns Checking account comes with 55,000+ fee-free ATMs nationwide and around the world within the AllPointNetwork.